Virtus Presents: The 2023 U.S. Real Estate Outlook

It’s been many years since there has been a more dramatic change in commercial real estate markets. The unprecedented interest rate increases have had a domino effect on a number of factors well beyond just borrowing costs. Learn more below.

Download the Article in .pdf

Executive Summary

In past years, our outlooks have offered a convicted narrative, even if “uncertainty” was a major factor. The current environment offers many of the same concerns we have touched on in past outlooks (i.e. – global instability, inflation, and the wind-down of historic liquidity), as well as new ones. All of it seems to have finally deflated the collective optimism of both generalist and real estate investors. As recently as a year ago, there was a wide range of both positive and negative projections from the most respected luminaries; these have coalesced into a more consistently dour view, even if the extent and timeline are unclear. Given the multitude of factors relevant to any view of the current world, we will begin by revisiting the key points from our outlooks from recent years, both to paint as complete a picture of the current landscape as possible, as well as remind the reader why this particular outlook may be worth reading:

- Real estate in general has fared well in all challenges facing investors, from capital preservation to yield and inflation-hedging—even if there has been the sector divergence we also anticipated, noting the “K-like” recovery pattern between sectors whose supply- demand dynamics benefited from the pandemic versus those that suffered.

- The most active Virtus asset classes have been at the forefront of performance in both fundamentals and valuation: Workforce Housing, Medical Office, and Student Housing assets have shown their needs-based demand factors.

- Historic Virtus Target Markets have been stars of both COVID-19 challenge and “recovery” so there was no need for a wholesale sector or geographic pivot (New Gateways).

- Workforce Housing proved both its needs-based resilience and ready exposure to growth factors from demand for high-quality yet affordable housing options (Affordability Series).

- Student Housing Beat Industry Expectations (Student Housing in a Post-COVID world).

- Office has lost its primacy in both tenancy demand and investor appetite while Medical Office has continued its resilient performance materially diverging from traditional office demand by both tenants and investors (2020 Outlook).

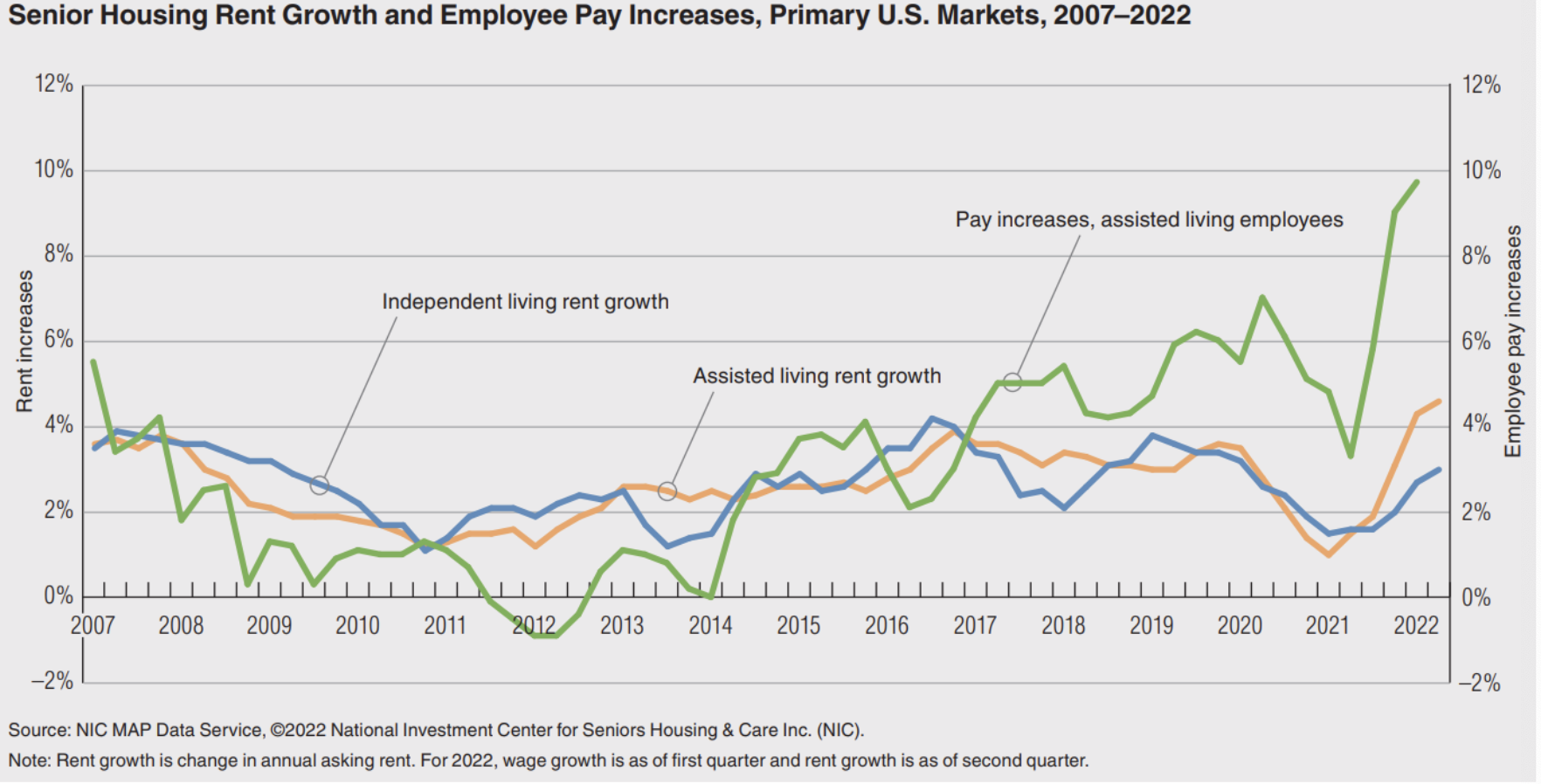

- Needs-based senior living has struggled initially from new supply and wage pressure (2018 and 2019 Outlooks) with occupancies being significantly impacted during the COVID induced lockdowns, which was exacerbated further by a deteriorating labor pool of senior living caregivers and professionals (2021 and 2022 Outlooks).

- The aggressive move to “risk-on” category CRE deals (momentum plays and/or extreme leverage to justify valuations by financially engineering levered returns) and other assets (from growth stocks already at historic multiples to wild west Crypto markets) have been punished.

What we could have seen better:

- We did not fully anticipate the extent of the late liquidity “sugar rush” in all asset classes (including both conventional and alternative real estate) that was driven by stimulus, but we did take advantage of the gains while present. Hindsight being 20/20, our risk management protocols prevented us from investing more capital during this prolonged sugar rush. Although we would not have done anything differently without violating said protocols, but our cycle-resilient criteria kept us out of a handful of hot sectors that have historically shown significant volatility, but which have ridden a wave of outperformance in recent years. This includes industrial generally, data centers, and other commodity type product that nonetheless rides strong technological tailwinds. The industrial surge (accelerated by both lockdowns and supply chain issues) has generally been the biggest trend of the recent past, and despite the sector’s historical volatility, we expect strong tenant demand by historical standards. Nonetheless, the rapid rise in both supply and valuations may find some deals destabilized as net absorption declines (along with the rate of e-commerce adoption, which has slowed).

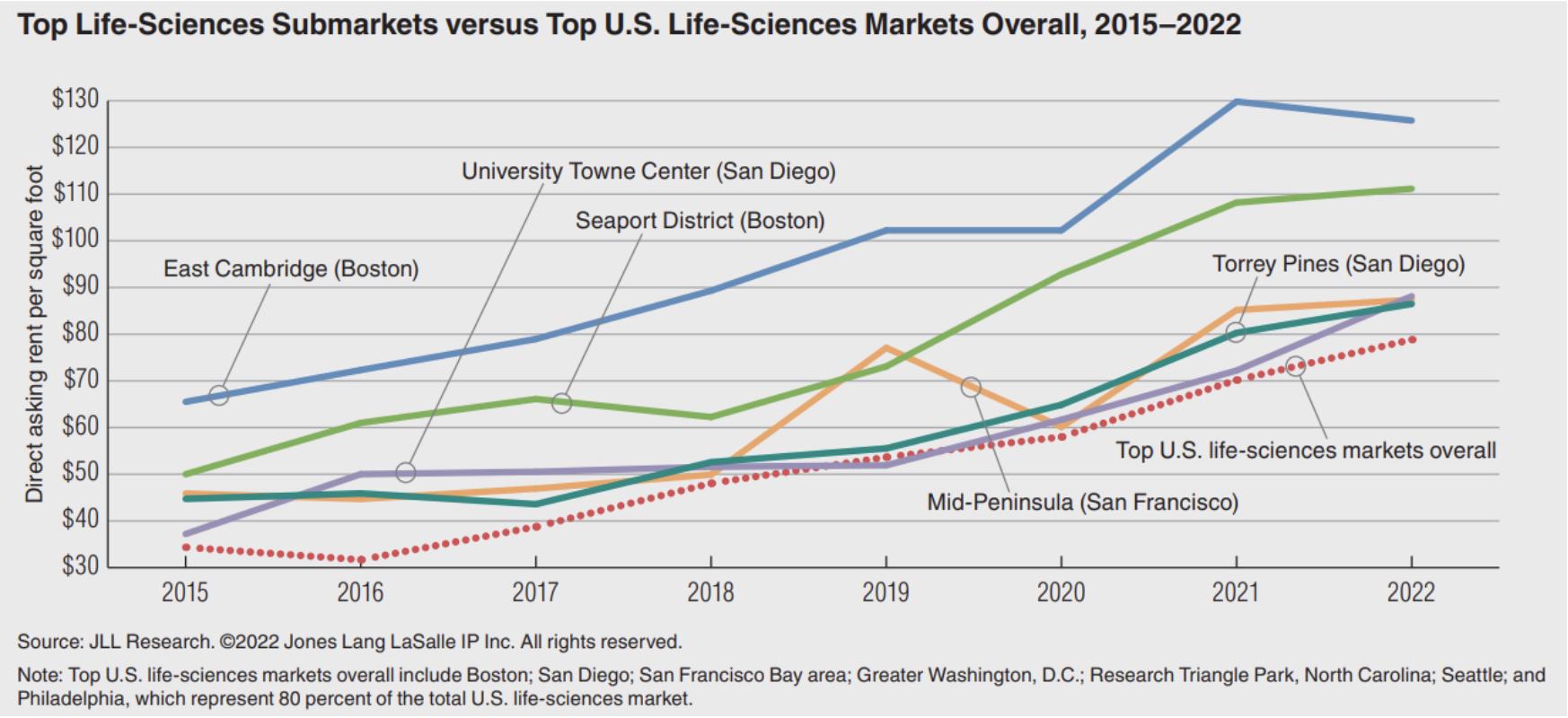

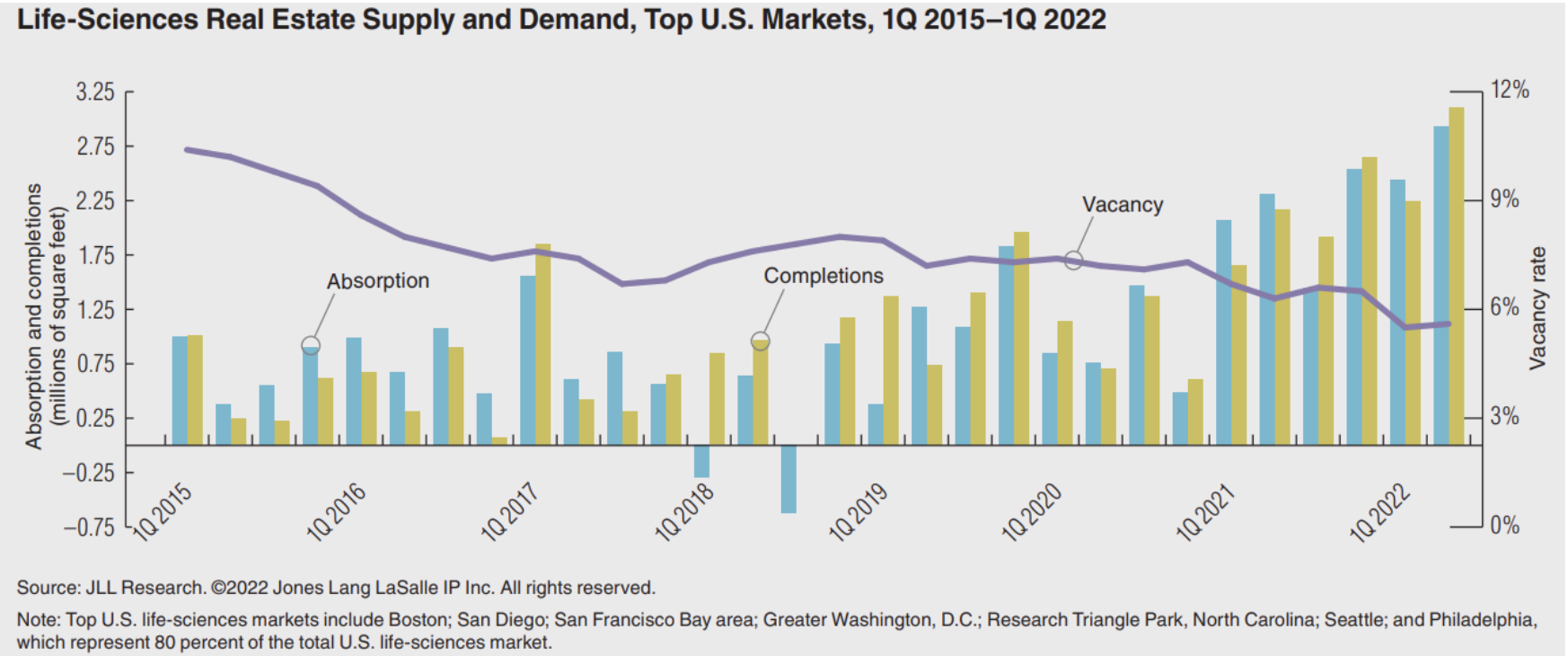

- We were less aggressive in pursuing the explosive life sciences sector despite identifying the opportunity early-on, because we were concerned about the credit quality of the tenants in special purpose, expensive spaces that did not seem readily transferable to another tenant. The pandemic and emergence of MRNA (and other revived or new areasof study and hence demand) by a burgeoning life sciences industry in need of built space certainly gave the industry a wide boost across all needs. Instead, we focused more on the safer play targeting cGMP facilities (FDA certified Good Manufacturing Practice buildings where R&D, manufacturing and /or distribution of bio science, biopharma and biotech products take place) and related models that seemed more defensible and less immediately prone to capital droughts from either venture or public markets.

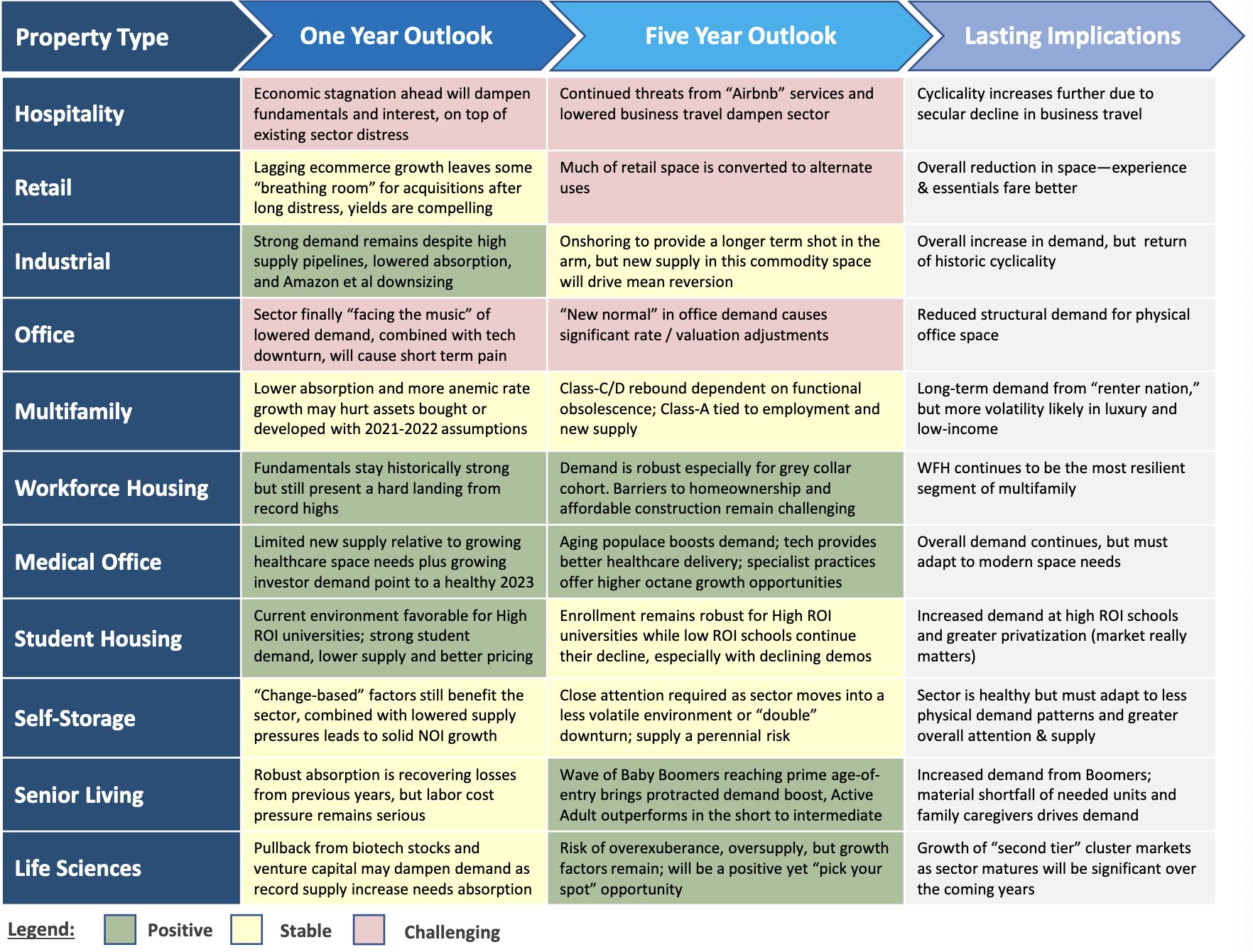

FIGURE 1: CRE RETURNS AND ECONOMIC GROWTH

Sources: NCREIF, NAREIT, Bureau of Economic Analysis/U.S. Department od Commerce, PwC Investor Survey.

*NCREIF/NAREIT and GDP projections for 2022 and 2023 are based on the PwC Investor Survey.

The Most Relevant Factors (Among the Many) Facing CRE Today:

- CRE repricing is being driven downward by a multitude of trends, albeit at drasticallydifferent rates dependent on the needs-based nature of the asset; the question is “howmuch,” as sellers are still anchored in years of inflated valuations. The “pseudo efficiency”of the past few years (in which valuations were at least fairly understood if not fullybelieved) has given way to a need for price discovery:

- Fiscal volatility and the wave of negative leverage clearly pull valuations downward,though the effects of each are complex. Past studies conducted by Virtus have seen no obvious connection between interest rate hikes and valuation declines in Virtus targeted property types—but the historic period available documents the period of institutionalization in these sectors, as well as the effects of quantitative easing during the GFC recovery supporting increased investor demand. Current evidence suggests a perceptible but less severe effect in sectors like Workforce Housing orMedical Office—especially compared to sectors like traditional Office, which have seen cratering deal flow.

- Normalizing in fundamentals will also reshape valuations—rent growth was at such record levels that even a return to historic averages represents a steep decline many deals have not been underwritten for in recent quarters. The magnitude of recent rate gains means the confidence interval for forward expectations is especially wide. Given the effect a simple 100 bps difference in projected rate growth can have on valuations for a typical five-year holding period, it is concerning how widely expectations for the future can vary.

- Although public REIT performance has historically been more correlated to theS&P500 and the whims of behavioral finance of the investing public than actual property performance, the significant decrease in REIT valuations may be prescriptive for what to expect in similar private market ecosystems, such as ODCE funds.Although it is unlikely the ODCE Index will experience such a significant and violent downturn as the NAREIT Index experienced in 2022, due to structural differences, the vector of performance for ODCE in 2023 will likely rhyme with the NAREIT in 2022.

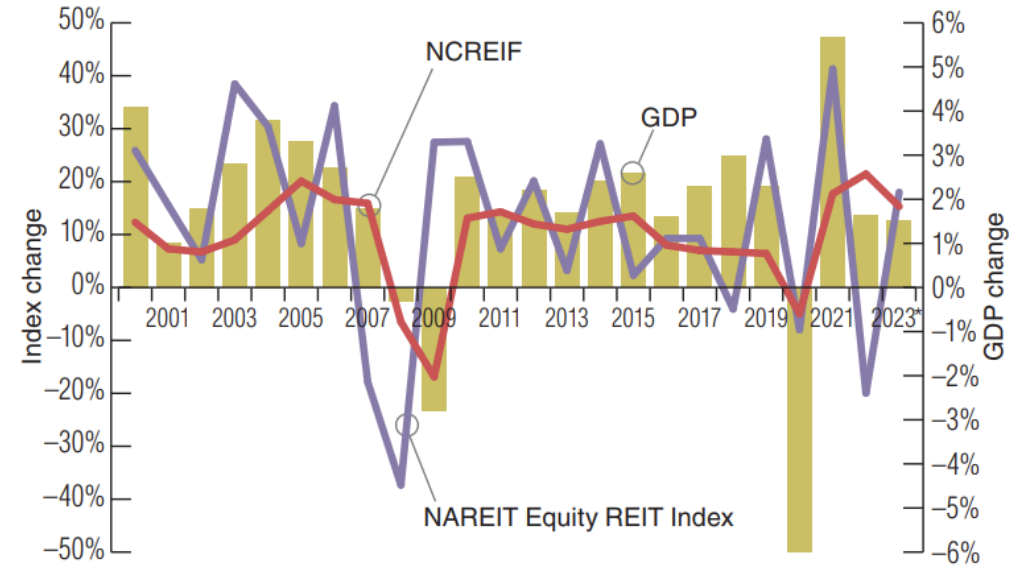

FIGURE 2: PROFITABILITY SURVEY FOR CRE

Source: Emerging Trends in Real Estate surveys.

- The world is forcing innovation in real estate, whether via regulation, market, or naturalincentives:

-

- Historic rises in housing and energy costs are pushing the need for disruption in both affordability and sustainability, respectively. These goals are often in tension,especially over a short development horizon, but solving them both is a clear imperative for the industry.

- Construction costs are not the only component of housing costs, but ramp-up in both labor and materials costs have made controlling them increasingly crucial.

- Zoning and other regulations continue to evolve, and not only developers but managers need an increasingly local literacy on both challenges and incentives unique to markets. The National Multifamily Housing Council (“NMHC”) recently estimated the total cost of regulation as 40% of total multifamily development costs— understanding where or how this figure varies is crucial.

- Environmental stewardship is increasingly central—both from institutional due diligence and the emergent awareness of present climate impacts.

-

- Divergence among asset classes consolidates success:

-

- For all its challenges, U.S. CRE continues to be a “giant among dwarves” as others ectors suffer. Investment appetite is limited chiefly by opportunity and even portfolio composition guidelines.

- However, the range of successful sectors is increasingly consolidated among cycle-resilient or future-oriented asset classes, while mainstays like Office and Retaill anguish. As such, investment volume and valuation can rise rapidly in niche-sized sectors.

- The result is a growing crowd in the few sectors that have consistently fared well in both the recent past and longer history. This is great for Virtus when wearing the seller hat and more challenging as a buyer. The biggest opportunity in 2023 will betaking advantage of over-leveraged owners and “hobbyists” in our more idiosyncratic sectors to find better entrance prices, stressed/distressed opportunities, and/orlower risk parts of the capital structure to source better risk/reward deals in 2023and beyond.

-

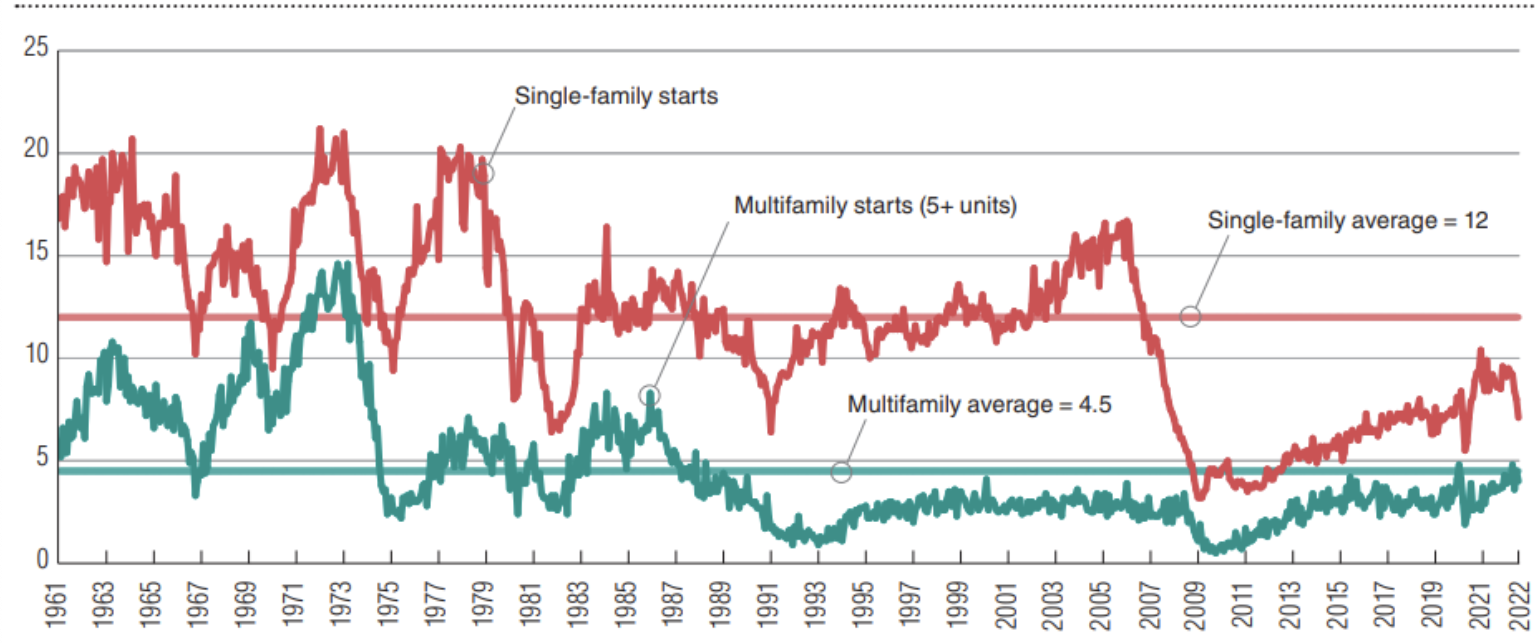

- Barriers to home ownership continue to be steep, and stringent zoning/regulations continue to make affordable development challenging. It was already extraordinarily difficult for a middle-income earner to cobble together the down payment for their first home purchase, and now that mortgage rates have more than doubled since 2021,purchasing power has been decimated and home purchases will have to be delayed for most in this income range (and hence demand for rentals, multifamily, SFR and BTR will remain high).

- Again, while supply growth is a concern in certain sub-markets or niches, the nation asa whole is beset by a housing shortage as indicated in Figure 5. The opportunity cost of development is extremely high, especially when it is often impossible to add meaningfully to existing unit counts due to zoning.

- This is counterbalanced by more anemic demographic growth ahead, as the Millennial echo boom gives way to the smaller “Zoomer” cohort and family formation continues to be delayed.

- Unprecedented annual rental increases may have saturated many renter household budgets, as housing has been the largest component increase in the historic CPI hikes. As such, some mean reversion in the sector seems inevitable. It is also worth mentioning that AMI growth has been broadly strong nationally, but with higher rates in centers ofhot population and job growth (e.g.-Austin, TX, Atlanta, GA, Raleigh- Durham, NC, etc.; see New Gateway Paper). This means some areas have seen rate growth chiefly prompted by the mass move to affordability (which occurred both within and between markets in recent years), rather than underlying income growth. Other markets, which have seen both strong population and economic growth, will likely fare better when adjusting to new demand patterns. This is made more complex by a change to HUD AMI calculations and income caps by family size—meaning effective AMI limits are below the actual increases to income for many markets, thus there is a difference between federal and practical affordability.

- Pricing will continue to catch up to preexisting realities, as decoupling of historic economic relationships brought on by government intervention has delayed typical correlations amongst those relationships.

- There will be continued worldwide transition away from globalization and free trade toward more onshoring, with manufacturing happening more proximate to centers of consumption due to both technological advances and political imperatives. This will ultimately influence regional economic prosperity, benefiting North America as a relative winner (although not a nominal winner) compared to other regions around the globe.

- The shift from an overly expanding monetary supply to now a contracting position to combat inflation will stay longer than recent hikes, meaning higher interest rates will be more persistent, but will begin reverting AFTER the U.S. likely enters a recession in 2H23.

- This above ultimately leads to a repricing of any interest rate-sensitive investments, as seen by the performance of fixed income in 2022.

- Although less sensitive, it also has a negative impact on commercial real estate valuations (which will also take longer to reflect in recorded values due to lower numbers of transactions).

- Simultaneously with a contraction in values, several categories of real estate are displaying poorer fundamentals in terms of supply and demand—meaning it will be difficult but necessary to distinguish between financial valuation impacts and direct income statement-driven ones.

- Cycle-resilient sectors have historically had no correlation between interest rates and cap rates, and although they are now experiencing that correlation for the first time, fundamentals generally remain very positive—even if supply and demand fundamentals decline relative to the peak periods experienced over the last couple of years.

- Much of the demand for housing and industrial was pulled forward as a result of COVID-19, meaning the immediate term may see greater than expected contraction. However, long term demand remains strong for both sectors, so it will be a big question of entrance pricing and supply risk.

- Valuations in the two healthiest of the basic food group sectors, multifamily and industrial, have necessarily had to decrease as their cap rates had fallen so low. Now that debt interest rates have surpassed cap rates (and will likely continue that path in the short term), there will be more pressure on valuations despite solid long-term fundamentals, as negative arbitrage is not sustainable, especially with declining rate growth assumptions.

- This will be a more interesting investing environment for cycle-resilient segments, given the backdrop of valuation volatility, increased relevance among large investors, and fundamentals that are historically solid in nominal terms but are declining relative to prior highs. Ultimately, we believe the lack of alternatives to these sectors (especially at scale) will be a decisive factor in keeping them both relevant and worthwhile.

-

Terrell Gates

Founder & CEO

-

Zach Mallow

Director of Research

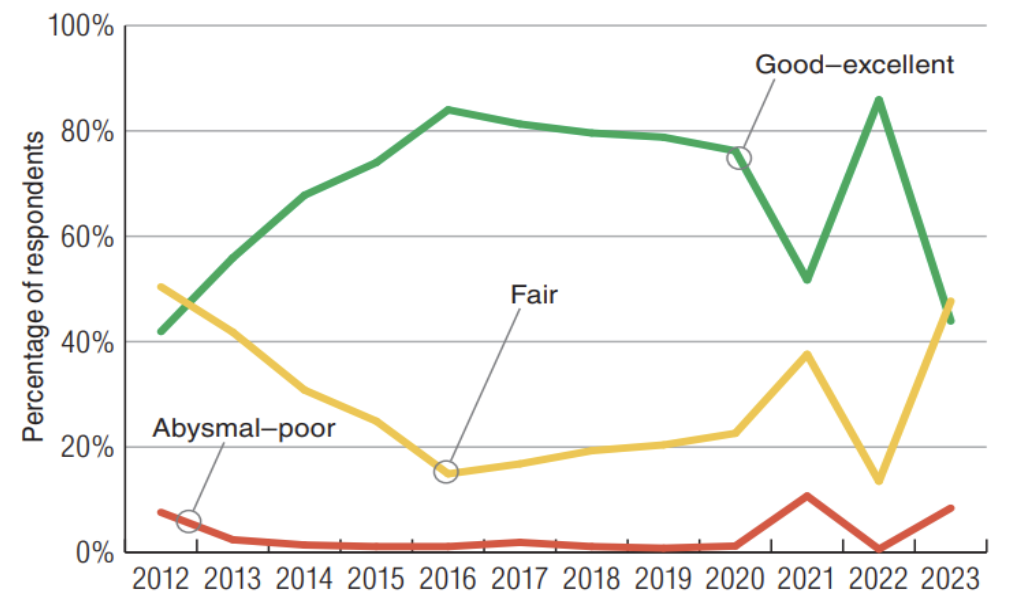

FIGURE 3: PRICING TRENDS

Source: RICA CPPI, MSCI Real Assets.

Note: 100 = December 2006.

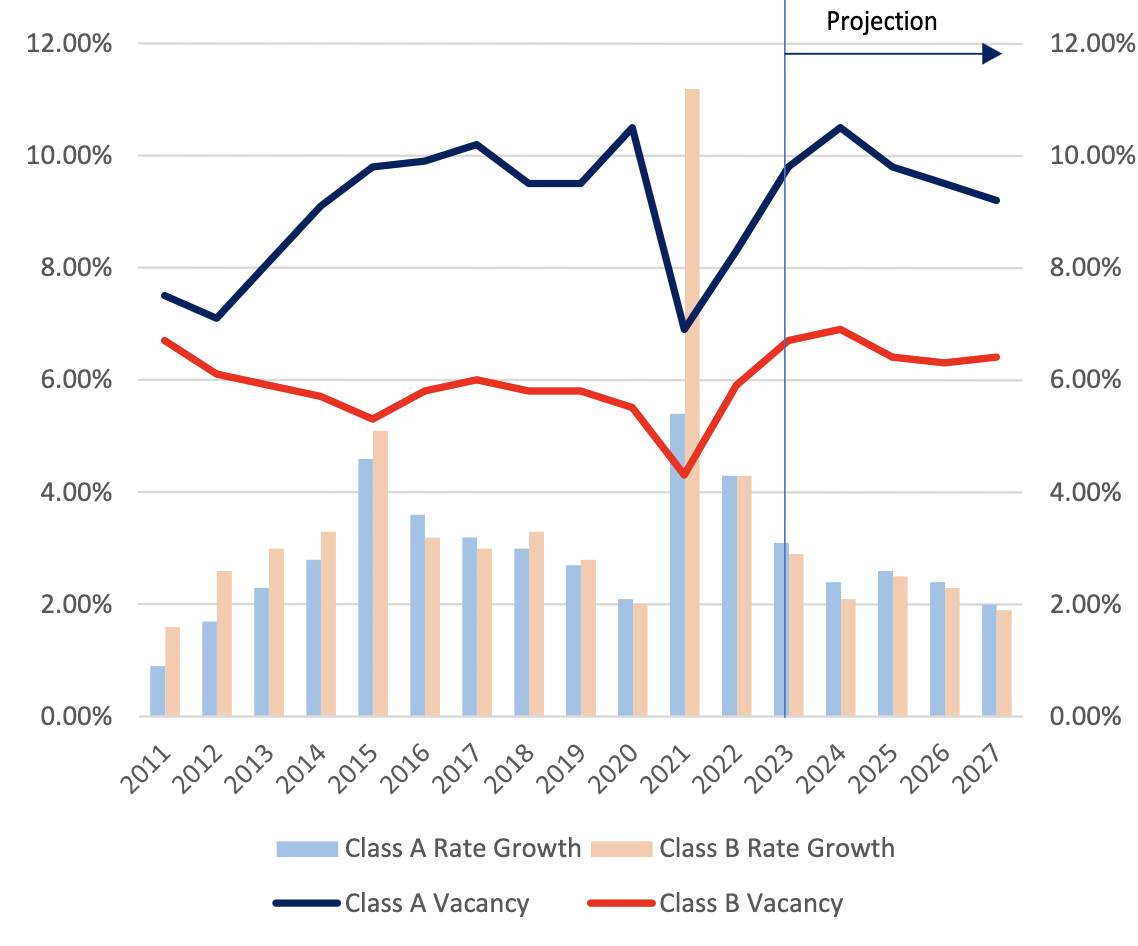

FIGURE 4: MULTIFAMILY VACANCY AND RENT GROWTH

Multifamily Vacancy and Rate Growth

Workforce Housing

ears of successful performance have established workforce housing among all types of investors, including longer term core profile portfolios. The protracted housing crisis has shown that even strong supply waves often fail to reach the middle of market rate rentals in any perceptible vacancy or rate concessions. This is due to the widening gap between rents affordable to typical renter households and rents required for a solvent new development on sites in a market with historically high valuations and rising construction costs. It is also worth noting that while recent supply waves have been high on a nominal basis, they have been lower as a percent of the rental population. In other words, the new product added in recent years may have failed to lower total rent burdens, but those burdens would have been worse for renters without it. Recent years have only exacerbated this trend, as quarantine boosted the importance of the home in both time spent and overall space. While rents began normalizing over 2022, that was only off historic rate increases totally unseen in the past. Minor occupancy declines seen in the start of the year have continued, especially for newer product with greater supply competition. Rate growth is declining more rapidly, but off historic highs never seen in past samples.

Projections from groups like CoStar show it normalizing within past historical averages around2-3% from a high of 11.2% for Class B product (admittedly, Virtus owns both Class A and B product, yet still affordable to renters making less than 80% of the Area Median Income or “AMI”). Largely, the multifamily sector is chiefly suffering from its own success, but the coming wind-down of historic highs coupled with a darkening economic outlook make foran increasingly complex landscape. Generally, Virtus expects workforce housing to continue thriving relative to other sectors, but this is due to both conventional economic tailwinds aswell as outright problems in need of more fundamental solutions:

FIGURE 5: HOUSING STARTS PER 1,000 HOUSEHOLDS, 1961 – 2022

Source: U.S. Census Bureau and U.S. Department on Housing and Urban Development; compiled by Nelson Economics.

Note: 2022 figures are through Jul

In sum, we believe Workforce Housing will continue to offer superior relative value compared to both the luxury end of rentals and low-income Affordable, as well as other forms of real estate. However, the coming years will still destabilize many deals that were neither priced, financed nor managed for the likely growth path ahead. In particular, the myriad of buyers who jumped into the space over the last five years or so, especially those who used high levels of leverage to financially engineer returns in a toppy valuation market will struggle the most. This will confer both challenges and opportunities for patient, experienced buyers/investors.

Student Housing

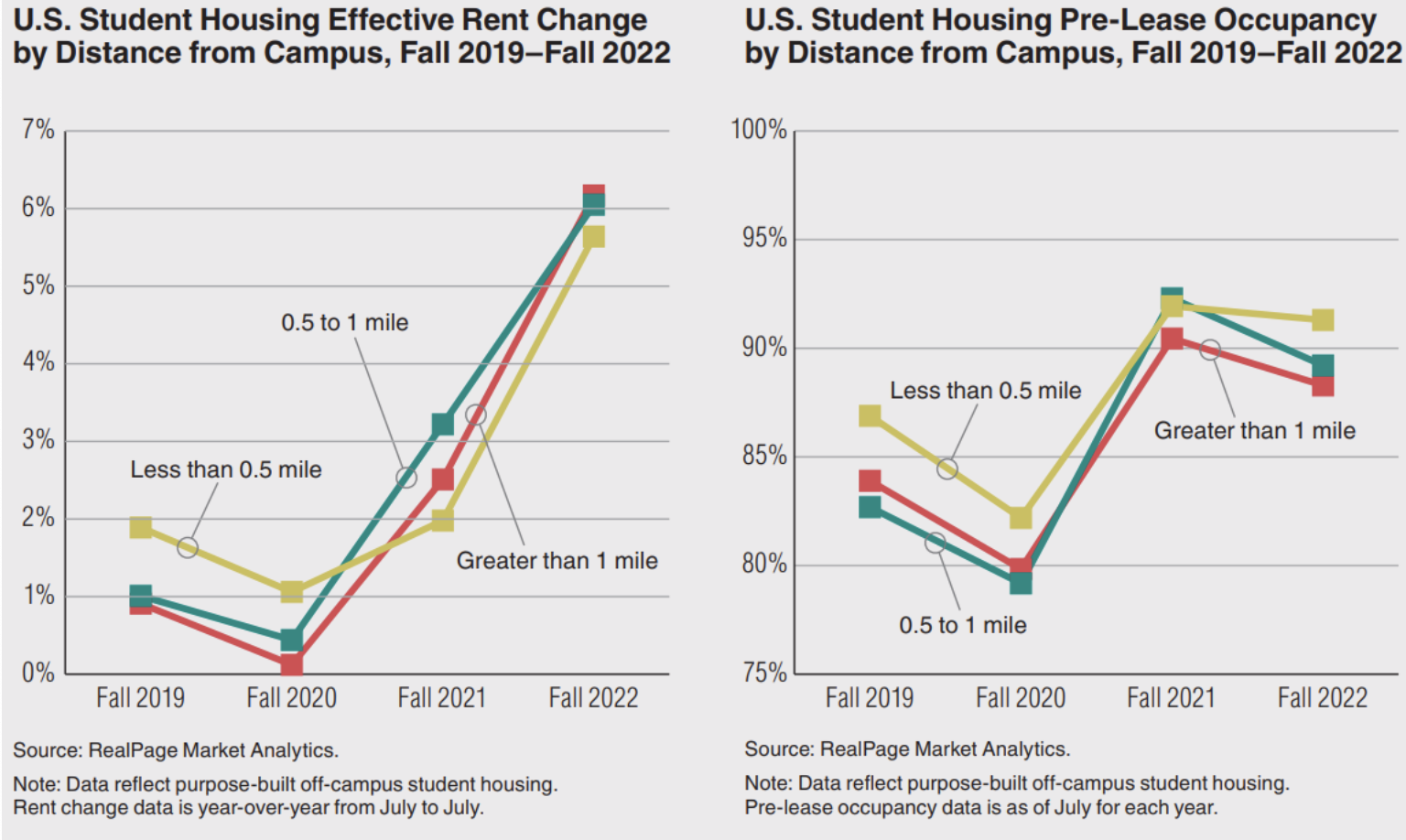

Virtus was more optimistic than most (at least for Tier I state schools with a great value proposition for students), but the sector has done even better than we expected. Student housing has historically displayed countercyclical demand patterns—as the opportunity cost of pursuing education is lower in downturns. However, lockdowns and unclear school policies led many to assume there would be pain in the sector—yet it has gone from surprising resilience during 2020-2021 to record highs in performance over the last year. The most recent leasing season concluded with historic rate growth double the prior years across both on-campus and off-campus assets and a 95.7% pre-lease rate.

Supply pipelines are active but much lower than recent years (with 2022 at roughly 25,000 beds compared to a recent historical average of 50,000+), as many deals were “scared off.” Despite this rosy situation, the forward outlook still requires diligence. Demographic challenges remain for the total undergraduate enrollment pool—whether or not immigration standards for offshore students continue to relax from a chilly state.

Market selection in student housing is more crucial than ever, not in just side-stepping oversupplied markets, but in targeting universities that are still growing enrollment and/or will have stable enrollment for the long-term. Future years must contend with a backdrop of declining college-aged students coming through the system, as well as lower matriculation to four-year universities as students and parents reconsider the ROI of a college education and the debt involved.

Nonetheless, as argued in our earlier white paper on the space, the declines and misfortunes of a lower quality school can benefit higher quality schools, much in the same way a local market of regional three malls can benefit from one closing. None of this distress has been seen yet in the space, but aspects of it are likely to emerge over the medium term. The greatest beneficiaries of this environment will be Tier I public schools in states with high in- place population growth rates and/or large inward migration patterns. These areas tend to have projected undergraduate growth far above the national average. These are generally found in Sunbelt states with historically high population growth (which is reflected in undergraduate enrollment decades later), much like assets in markets Virtus has been active in during the last few years. University of Georgia, Clemson, and The Ohio State all presented attractive opportunities Virtus felt had been lacking in the pre-COVID-19 environment, and other more highly followed universities (like The University of Texas at Austin) will likewise see resilient enrollment and overall institutional health.

FIGURE 6: STUDENT HOUSING RENT GROWTH

Medical Office

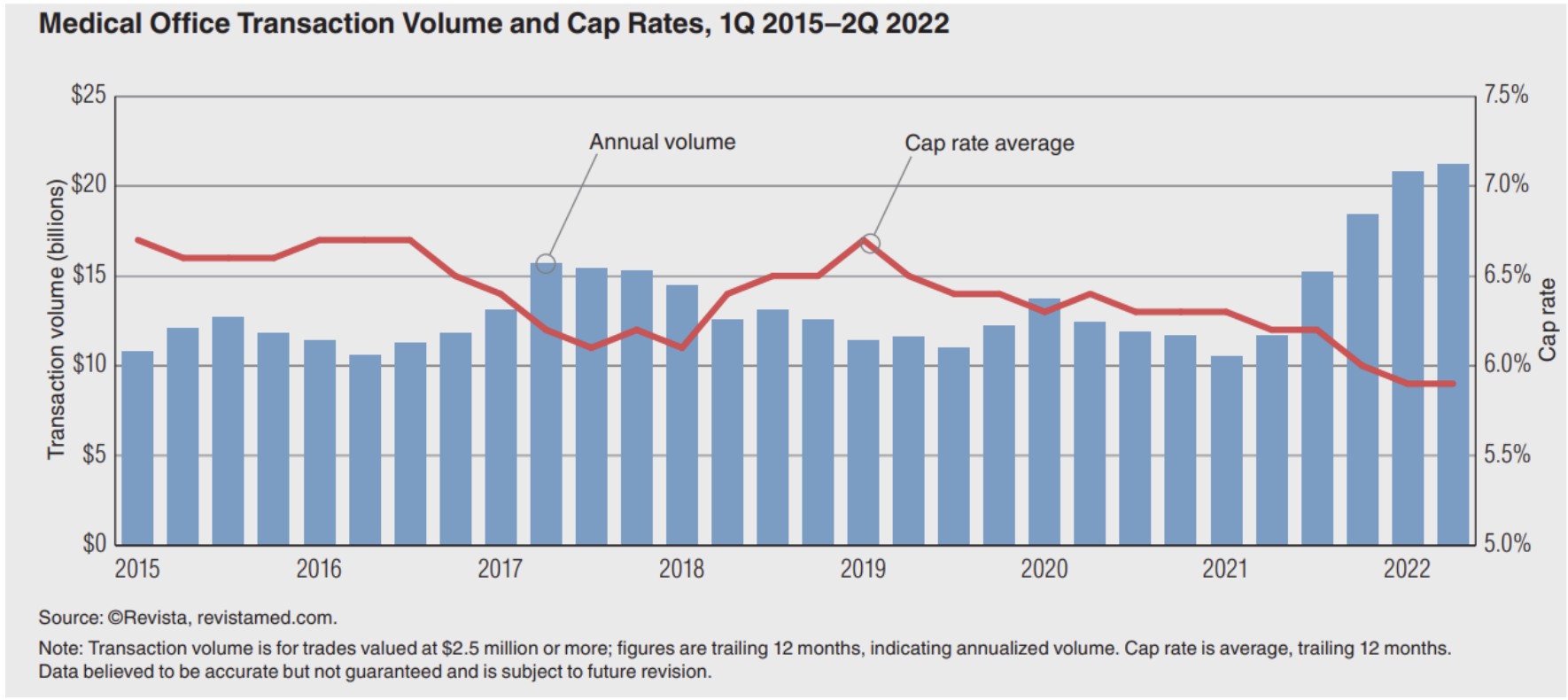

Historically, MOB valuations have been correlated to office, despite having a safer and more resilient income stream. Indeed, during the most robust growth periods before Covid, medical office was generally penciling as a core-oriented sector chiefly due to the long leases and low escalations in the space (compared to higher annual multifamily lease rebalances). As conventional office has suffered from protracted demand slumps and changing preferences in floorplan, the resilience of medical office yields has been a greater selling point. Further, as more investors have discovered the sector, MOB has benefited from conventional office’s decline in appetite, and that historical correlation is eroding. Despite any outward similarities, medical office is a distinct class both spatially and operationally—and the majority of conventional office product (especially dated buildings) cannot easily be repositioned as MOB space. And while the topline escalation potential of most MOB assets has a ceiling, the demand growth on the immediate horizon counters this.

Medical office assets are bolstered by demographics, especially given the age of the current “Boomer” cohort. Further, while many real estate sectors were disrupted by digital solutions that replace them, there is greater harmony and less direct cannibalism from digital solutions. Telehealth does not obviate the need for a physical doctor office, though it may increase floorplan density. In sum, the sector is likely to stay a strong and crucial part of the Virtus portfolio at least through the foreseeable future. Parallel to the more defensive traits of typical MOB complexes, there will also be more risky and accretive opportunities in niche forms of care delivery like inpatient rehabilitation facilities and ambulatory surgery centers, both of which benefit from the transition from care-based to value-based regulatory standards. Further, certain specialty healthcare facilities, such as behavioral health, are benefiting from increased patient needs and availability of insurance reimbursements. These will require greater diligence in both sector and local market characteristics, but the combined demographic and regulatory forces benefiting them will likely make the exercise worthwhile.

FIGURE 7: MEDICAL OFFICE TRANSACTION VOLUME AND CAP RATES

FIGURE 8: SELF-STORAGE NOI GROWTH

Source: NAREIT.org T-Tracker 3Q2022, Sourced January 2023

Self Storage

Thriving on change as usual, self-storage has soared upward from a pre-COVID-19 slump brought on by supply and economic stasis. Rental rates and NOI growth went from concerning lows to historic highs through both the late pandemic and recovery. Like student housing, the sector’s demand has historically displayed countercyclical behavior, since in downturns it is cheaper for households to consolidate rents and store excess belongings. The high rate of moving both within and between cities also boosted demand, which is why storage also benefits from recovery periods. Indeed, both the pandemic and recovery have provided a constant flow of volatility that has boosted demand for space. In addition, supply pipelines are high but much lower than in the recent past, and REITs are much more active net buyers than before the pandemic—effectively tripling their net acquisitions during 2021-2022 compared to pre-COVID-19 years according to NAREIT. While all of this bodes well for the current environment, it is still necessary to be careful about entrance pricing given all the new players who have once again gravitated to the space. Self-storage has generally suffered from these post-recovery supply and valuation waves more than downturns themselves, and places with low barriers to development are especially prone to rapid reversals in the competitive landscape. Similar to workforce housing, those newer entrants using elevated levels of debt (compared to leverage available in 2023), especially for ground-up development, will display capital structure distress, creating opportunities for well-capitalized investors.

Senior Living

Once the hottest niche within alternative property types, senior living has been experiencing doldrums in both performance and investor interest since COVID-19. However, there are glimmers of brighter times ahead, as leasing activity has inflected upward and demographic tailwinds in the Baby Boom generation are poised to benefit higher age-of-entry sectors like assisted living over the coming decades. Indeed, leasing activity rose to nearly double pre-COVID-19 rates in nominal terms—although this was obviously catchup from prior years where absorption was starkly negative. It is worth remembering this stagnation also derives from a preexisting supply wave that was beginning to swamp some sub-markets as early as 2018, when the Firm discontinued new investments in the space well ahead of COVID-19, both out of concerns for supply and rising labor costs. The topline risks of pandemic only made this more difficult, and the near-total stop of leasing efforts put a strain on many rent rolls that were already behind their business plans, combined with skyrocketing costs in labor (another pre-COVID-19 problem) as the shortage of medical caregivers became even more acute. To be sure, the worst experiences were largely concentrated among higher acuity models like skilled nursing, as well as the most aggressive late entrants to the sector (or any given sub-market). The Virtus portfolio of existing assets stayed well above industry norms in both rate and occupancy, although pre-existing senior assets have performed meaningfully below original expectations in a post-COVID-19 environment. Nonetheless, we remain dedicated to senior living on a longer horizon, as the graying of the American population is beginning to benefit demand patterns for this space, where average age-of-entry is much higher than the 65+ landmark where medical office demand grows.

Nonetheless, the most recent period before COVID-19 shows that the sector has grown capacity to build in strong waves that can overtake local demand. The picture is further complexified by needing to study both migration patterns (which affect adult-child-caregiver decisions) as well as in-place senior populations that derive from demographic patterns decades ago. In addition, some business models will work in markets of one type (for instance, an affordable market rate development in a market with low growth but high in-place senior population) but not in a different type. In general, Virtus believes there is a great need for solving both affordability challenges for moderate income senior households, as well as satisfying the changing desires of more affluent households in models for aging. As such, the near-term is expected to overweight sectors like Active Adult (or age-restricted apartments) rather than higher acuity spaces that are still waiting for the demand wave and are currently beset by labor cost hikes. Nonetheless, more challenging models will always retain an opportunistic appeal and are likely to be strong spaces in the more medium-term future.

FIGURE 10: SENIOR LIVING OCCUPANCY AND RATE

Life Sciences

This sector has been another new gravity center for capital since the pandemic, which is unsurprising given that the sector exists to house and support firms like Moderna. The entire space covers everything from corporate offices, clean lab environment research space, and drug manufacturing space, though generally R&D space is the dominant focus of investment interest. Virtus had already conducted many preliminary studies of the sector years before the pandemic, and had begun investing in niches where we felt the inherent volatility of the underlying business could be managed. Indeed, the space is extremely complex, with an immense potential for the type of growth the early tech boom conferred on some cities. However, there are parallel challenges of declining innovation value in conventional pharmaceuticals, plus the constant influence of both public biotech stock performance and venture capital availability. Also, life sciences has a more entrenched REIT presence (via Alexandria) with greater expertise and network advantages than are seen in other niche asset types with commodity product needs.

As such, there are more present operational risks when going down market where tenant credit or maturity of business model are lower, compared to other sectors where landlords have greater control over the underlying success of the asset. Virtus has historically stayed away from the riskier tenant profiles and buildings, and we continue to overweight safer plays of healthcare research and manufacturing, such as cGMP and similar—essentially, business models that require a mature and developed product rather than R&D space. Still, the entire sector shows extremely strong fundamentals, but with some nascent evidence of growth fatigue after the end of COVID-19-era bio-stock bumps and subsequent decline. Supply growth has also been extremely high in recent years. Asking rents in Boston/Cambridge (the largest and most important hub) fell for first time after consistent growth for over a decade. Rates are still consistent in less central hubs, but some may follow suit in pockets where supply waves now outpace the demand in a changed sector with fewer short-term boosts and a much grayer capital environment. Nonetheless, Virtus will continue to have a proactive interest in the sector, determining the relative value of different business models in any given capital environment, as well as the longer term value proposition of the underlying business. This complexity forms a barrier of expertise, even if it is unrecognized during more forgiving environments.

FIGURE 11: LIFE SCIENCES FUNDAMENTALS BY MAJOR HUB

Conclusion

If there is any consistent narrative in the above, it is that the present moment is characterized by such a multitude of factors that any effective analysis must balance a comprehensive view with an eye toward the most crucial influence points. Any given deal will face impacts from local sub-market supply dynamics, shifting patterns in employment, and an increasingly volatile fiscal and geopolitical landscape. Some of the factors below will be more relevant in one specific sector or deal, but the following trends will collectively define the landscape going forward:

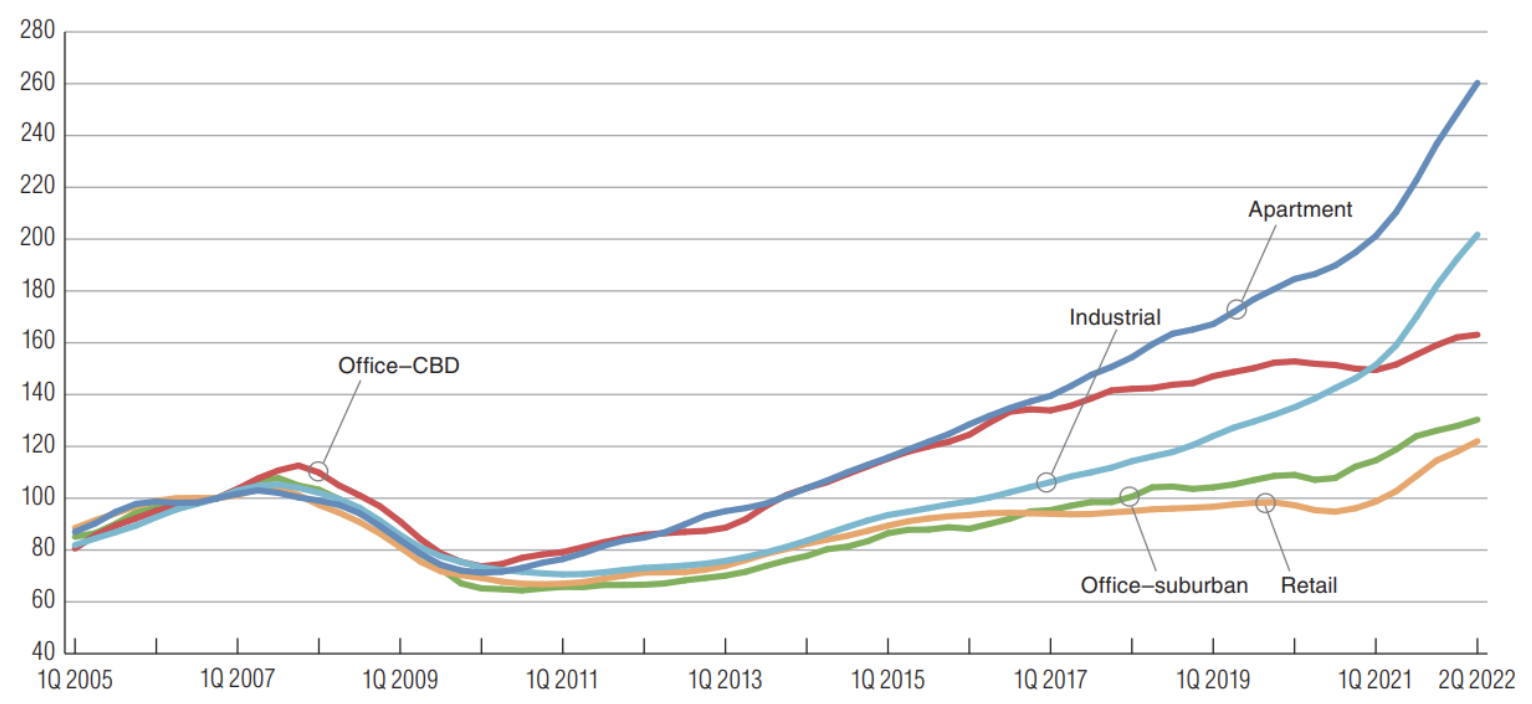

FIGURE 12: 2023 MARKET OUTLOOK