The impact of climate change on commercial real estate markets has long been underappreciated due to the pervasiveness and time distance of expected effects. However, that sentiment is beginning to shift due to the increasing occurrence and cost of weather-related disasters. In our latest white paper, we take an in-depth look at the various conditions, including water availability, extreme weather, and an evolving regulatory environment, and explore how these will impact the future of commercial real estate investments.

Download the Article in .pdf

Executive Summary

The impact of climate change on commercial real estate markets has long been under- appreciated due to the pervasiveness and time distance of expected effects, but this situation is beginning to shift due to the increasing occurrence of weather-related disasters that follow predictive models. It is irresponsible to use single anecdotes as evidence either for or against climate trends that are measured in decades or centuries, but the long-range data seems quite clear that climate change will have long-term pervasive effects throughout the globe, with immense implications for commercial real estate. The most immediate and obvious effect will be greater disruption of coastal gateway markets, as well as other major metros in the Gulf of Mexico region, which is particularly exposed to coastal erosion. Nonetheless, even the relative beneficiaries of these shifts (inland growth markets) will likely see increasingly volatile and destructive weather patterns, and these will also have financial impacts. The rising prevalence of value-destroying weather events—as well as the increasing role of ESG concerns within institutional investment circles—means climate issues will become a more central strategy concern that real estate managers must incorporate into their diligence. While shorter horizon investors may still justifiably treat these concerns as peripheral, core-oriented investors with long or indefinite holding periods (and who are likely to sell to similar buyers), will benefit from proactive engagement with this issue. This is because when examining the full range of risks climate change poses to commercial real estate, the most obvious challenges are not the most immediate or relevant to real estate. Indeed, climate change poses a variety of problems to real estate managers:

- The direct, permanent effects of climate change on individual properties: this includes sea level rises or other destructive changes that fundamentally change a market. These are the types of terminal scenarios many investors consider first when thinking of climate change, but they are also distant and unclear in time horizon.

- More germane are episodic risks like hurricanes, floods, or droughts. These types of issues are often handled separately from macro “climate,” but evidence has shown climate change is exacerbating the likelihood and severity of such storms. Insurance coverage is still evolving in acknowledging (and paying for) this association.

- Substantially higher insurance premiums in markets or sub-markets with increased flood risk, as well as increasingly stringent building codes and regulations. Our full report enumerates many of these trends, which involve both market forces and policy shifts at the federal level that are likely to continue.

- Increased diligence and reporting standards, led by both federal agencies and major institutional investors who are increasingly adopting ESG concerns into their standard underwriting. The SEC recently announced new climate disclosure standards, which are already a reality of institutional due diligence. Managers who fail to communicate their firm’s environmental impact policies will increasingly fail to meet capital goals, and for this reason alone, the topic is worth engaging even for skeptics.

In sum, the full ramifications of climate change for commercial real estate remain to be experienced, but there are already numerous and material risks for owners. Last year, the total direct costs of climate disasters totaled $120 billion — second only to 2017’s record

of nearly $150 billion. These costs will only grow over time, and all current evidence points toward property owners taking a greater share of risk. As such, the sooner real estate managers assess their business plans for climate risks the better. Currently, getting ahead of the issue offers an advantage, but engagement will likely become part of a general “license to operate” at higher levels in commercial real estate.

Introduction

It probably seems like an unwelcome time to talk about climate change in an environment

of lingering pandemics, murky economic trajectories, and geopolitical chaos. Of course, the distanced nature of climate impacts, in both time and locality, means this issue habitually takes secondary focus until specific disasters—such as tropical storms on the Gulf Coast or historic wildfires on the West Coast—pivot the news cycle back toward such topics briefly. The resulting situation is one where climate issues seem too universal to bother with application to specific business plans—or else too local for larger conclusions on ideal policy response. However, the issue benefits from a macro scale assessment that neither episodic media narratives nor extreme political rhetoric make possible. The polarizing partisan talking points around climate change obscure a much more centrist approach shared by practically every major power center. On the one hand, the most alarmist voices within government still converge on incremental regulations that minimize industry disruption, especially as their positions evolve from campaign platform to policy. On the other hand, vocal skeptics are surprisingly cautionary on their home turf—as exemplified in Virtus’ home state, where “’future proofing’ is how you say ‘climate change’ in Texas” when requesting federal funds for coastline remediation and maintenance.

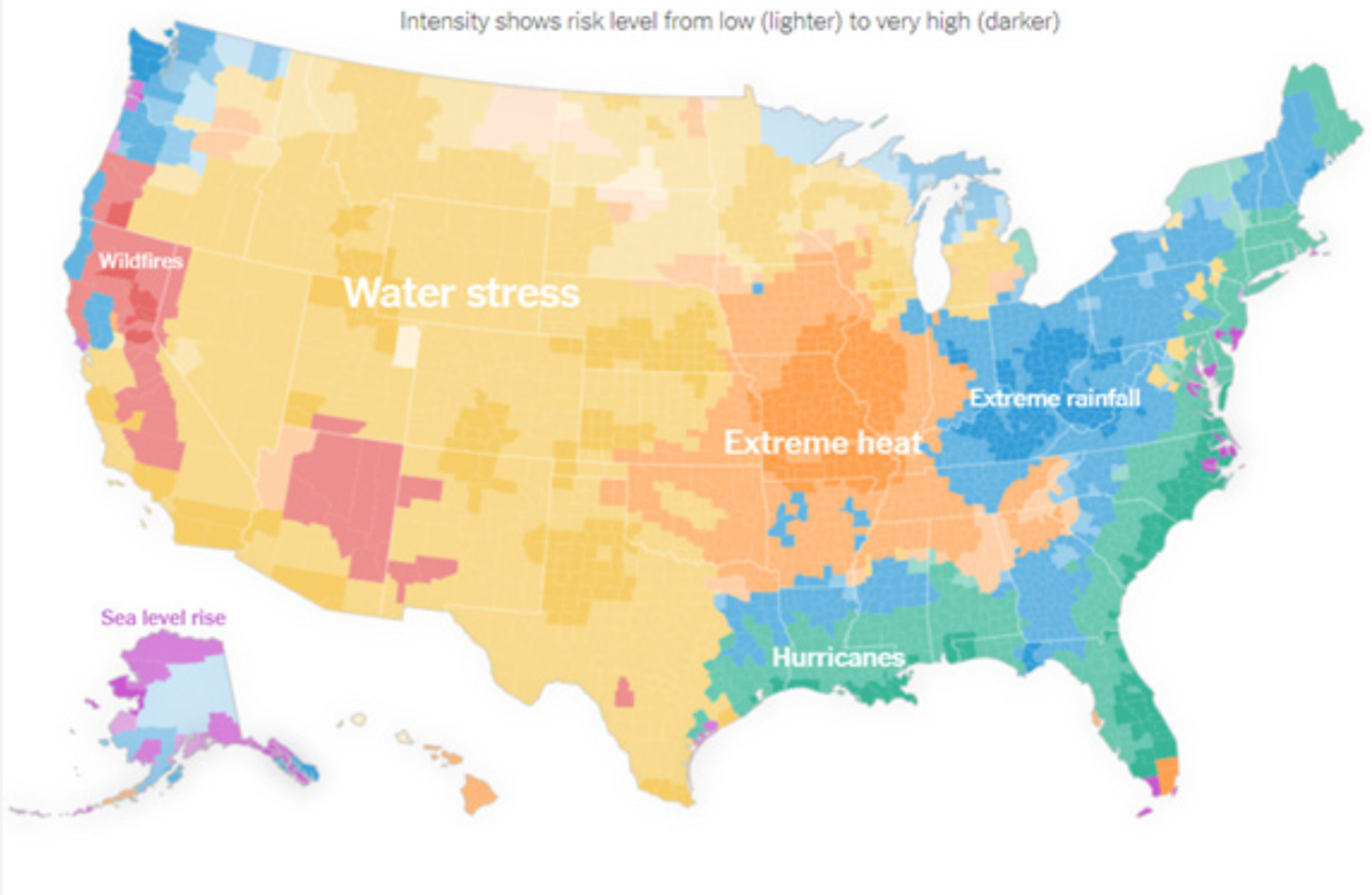

In fact, the multi-billion-dollar effort to shore up the Gulf coastline from hurricane damage— ironically to primarily protect oil and gas infrastructure—is a portent example of the current implications of changing climates. In this wider view, the threat is less a snap apocalyptic scenario than a slow bleed of outlays, as “hundred year events (or 500-year events)” play out with increasing frequency. A macro view of climate issues also means getting beyond the simplified “global warming” concept, instead noting that climate change means disruption of existing patterns for more volatile and unknown weather—droughts in some areas, extreme storms in others. Further, it is overreaching both statistically and philosophically to say that climate change has “caused” any specific disaster; instead, it is more accurate to say existing models predict increased coastal erosion in certain types of areas, extreme heat or wildfires in some, and water stress in others (as shown in Figure 1). Importantly, these effects will not be confined solely to coastal areas, as inland regions are expected to see shifting rainfall and heat patterns.

FIGURE 1: WHAT TO CALL CLIMATE CHANGE WHERE YOU LIVE

Source: “Every Place Has Its Own Climate Risk; What’s Yours?”, NY Times. Sept 18, 2020

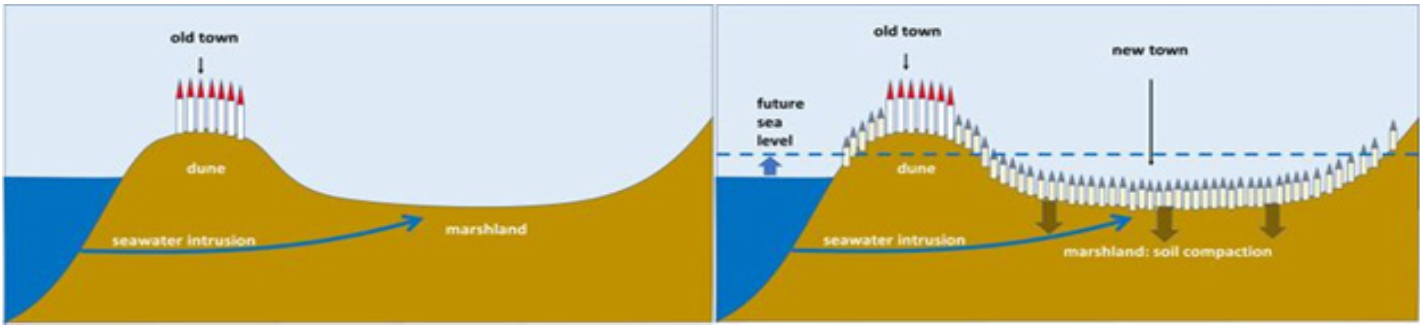

Nonetheless, the most pervasive and projectable impacts relevant to real estate will involve coastal areas exposed to rising sea levels and increasingly damaging hurricanes and areas exposed to increased heat, drought, and wildfire risk. Storm tides and land erosion are likely to have more lasting destructive impacts on built space than most other forms of extreme weather like rainfall or temperature shifts. These latter forces may still affect productivity, agriculture, or quality of life (and thus property values), but their impact is likely to be both more diffuse and universal than the highly localized and total threat posed by sea levels. As such, the most cited risk assessments of climate change generally revolve around coastal exposure and FEMA 100-year floodplains—both maps based on current sea levels and those projected after future rises. Since water access was both the lifeblood and landfill for pre- industrial communities, this means many of the world’s foremost cities are heavily exposed to significant flood risk. The simple diagram below shows why this is a more complex assessment than mere distance from the water, as the founding locations of cities were frequently more careful than subsequent growth expanded beyond.

FIGURE 2: URBAN EXPANSION INTO LOWLANDS

Source: “Every Place Has Its Own Climate Risk; What’s Yours?”, NY Times. Sept 18, 2020

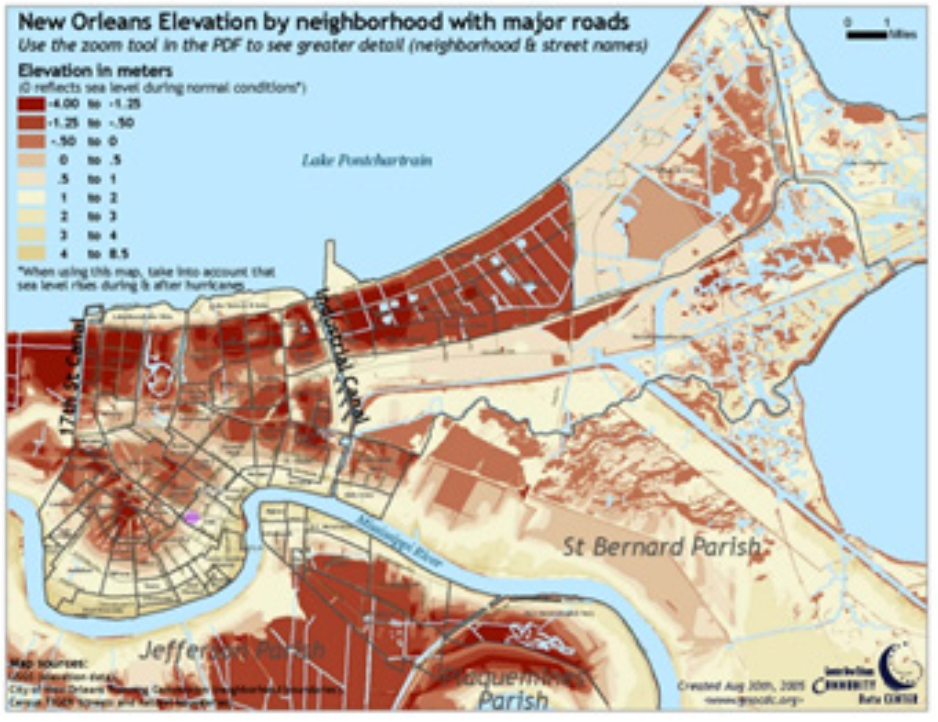

This is also why facts like “much of New Orleans was built below sea level” are true despite how absurd they sound. Indeed, that city’s flood plain map shows how varied elevation changes can be at the micro scale, meaning the difference between a flooded and functional building can be a few city blocks. While New Orleans takes much of the Gulf area’s headline attention, coastal erosion and storms pose a greater value-loss risk to South Florida, which has historically been a greater magnet for both population and commercial real estate investment. In addition, hurricane risk means that foundation height, wall type, and roof assemblage are all details that become increasingly important in a time of more frequent “century storms,” especially in areas where regional building codes and customs are varied or outdated. In cities highly affected by coastal risks, this kind of diligence will be increasingly necessary at the level of individual investments.

FIGURE 3: NEW ORLEANS ELEVATION BY NEIGHBORHOOD WITH MAJOR ROADS

Source: Climate Central Risk Assessment Maps

This is also where the issue of insurance coverage and rates come in. While the risks of true “headline” climate change seem difficult to underwrite in any responsible way, the very real and current threat of rising insurance outlays are currently evolving. Earlier in 2022, the Treasury Department assigned the Federal Insurance Office (“FIO”) to collect data on the adequacy and oversight of private insurance in the context of climate related storms, with Treasury Secretary Yellen noting “the incidence of natural disasters has dramatically increased and the actual and future potential cost to the economy has skyrocketed. We are now in a situation where climate change is an existential risk to our future economy and way of life.”

This high-level engagement is unsurprising when considering how underfunded federal emergency remediation programs are compared to their recent needs. Recently the National Flood Insurance Program (“NFIP”) collected only $3.6 billion in insurance premium revenue compared to $12.3 billion in total outlays. This deficit is increasingly drawing the attention of both fiscal conservatives and environmentalists concerned that the government is footing the bill for externalities not yet fully priced in. Going forward, sector legal experts expect stricter insurer underwriting and more specific language related to climate threats, including:

- Loan covenants that include requirements for more comprehensive policies or longer holds on properties with high flood risk defined by FEMA.

- Higher interest rates or additional fees on such properties.

- Change in NFIP coverage of areas or properties with repeated storm damage that constitute a “moral hazard” for full federal coverage. According to FEMA, 30% of total payouts have historically gone to such claims.

In short, the federal government seems increasingly concerned about this issue, from both a fiscal and social policy framework. Insurance markets equally seem poised to respond to

a changed regulatory environment. While the specific character these changes will take remains to be seen, all evidence points to a future where rising costs related to climate risks fall increasingly on property owners. Again, this will require greater property-level diligence, because two properties that are currently treated the same way by federal and private organizations may be treated in markedly different ways soon.

While it is not yet possible to define exactly how changing policy and disclosure requirements will impact real estate values, it is worth noting that many different influence centers are converging on common requirements. For instance, the SEC will soon be requiring both disclosure of investments located in FEMA 100-year flood plains, as well as more qualitative assessments of how climate change (including “severe weather events and other natural conditions”) will affect a firm’s overall strategy, business plans, and outlook. While such latter requests are still open-ended, they have strong echoes of the same concerns shared by both institutional investors and associated non-profit organizations who create reporting or accounting standards. The Sustainability Accounting Standards (“SASB”) and Global Real Estate Sustainability Benchmark (“GRESB”) are two such organizations whose frameworks are increasingly influential within institutional investment circles. SASB offers an impact standard where any “reasonable investor” would care to be apprised of sustainability concerns along the following:

- Financial Impacts and Risks

- Legal, Regulatory, and Policy Drivers

- Industry Norms and Competitive Drivers

- Investor/Stakeholder Concerns and Social Trends

- Opportunities for Innovation

The above topics are organized in descending order of importance and specificity and apply to all sustainability concerns under the SASB purview. Obviously, financials are foremost, and even most risk categories beneath this will impact properties financially. That said, there is an emerging body of analysis seeking to quantify the value effects of natural disasters. In a recent study conducted with the UN Environment Programme Finance Initiative, researchers summarized all existing estimations of disaster-related damage erosion. They found numerous examples of immediate, short value declines due to coastal storms and wildfires— as well as several examples of persistent value declines. For instance, while homes damaged by Hurricane Sandy saw an immediate 17-22% price decline that gradually rebounded, the subsequent revision of FEMA floodplain maps saw a permanent 8% decline in value. As both climate awareness and regulation of storm-prone areas grows, it is likely such repricing behavior will become more common and material—especially when involving direct costs like higher insurance premiums. Indeed, the financial impacts of climate risks range from extremely acute to diffuse, since so many different factors are involved. Specific to climate, SASB asks managers to account for how the following challenges associated with climate change will impact investments:

Availability of Water – This issue is frequently glossed over when projecting rising sea levels, but the same factors driving more volatile coastal weather also cause drought areas. The National Centers for Environmental Information currently assess at least $9 billion annual losses related to drought—a figure likely to rise in coming years. Further, even coastal areas can have infrastructure destruction during storms that disrupts access to drinking water.

Extreme Weather Events – As discussed, the increasing prevalence and intensity of destructive storms and other extreme events is increasingly being acknowledged as a facet of climate change. This will slowly shift the way events formerly seen as “force majeure” are treated in areas with frequent and expected destructive storms.

Evolving Regulation / Legislation – Against a changing landscape of risk, it will be incumbent on managers to anticipate coming regulatory shifts with potential for business plan disruption and account for them.

Impacts on Regional Infrastructure – This is a reminder that even individual properties located beyond storm zones may still face value destruction if located within a metro with enough climate exposure to destroy infrastructure, including transit and logistics lines crucial for everyday needs. Recent disasters in both New Orleans and New York saw greater disruption from infrastructure issues (i.e.- loss of electricity or transit availability) than direct storm damage.

Impact on Tenant Demand – While less concrete to project than the above concerns, the impacts of changed demand are no less destructive. This could involve a lower lifestyle magnetism for existing capital centers like New York or else decreased tourism for places formerly known for coastal amenities and natural beauty.

SASB demands managers account for these challenges including the timeline over which such risks and opportunities are expected, as well as how they will alleviate or adapt to them. This process will always start at the asset level, as individual streets and blocks have very different elevations and thus sea level risks.

From Streets to Cities

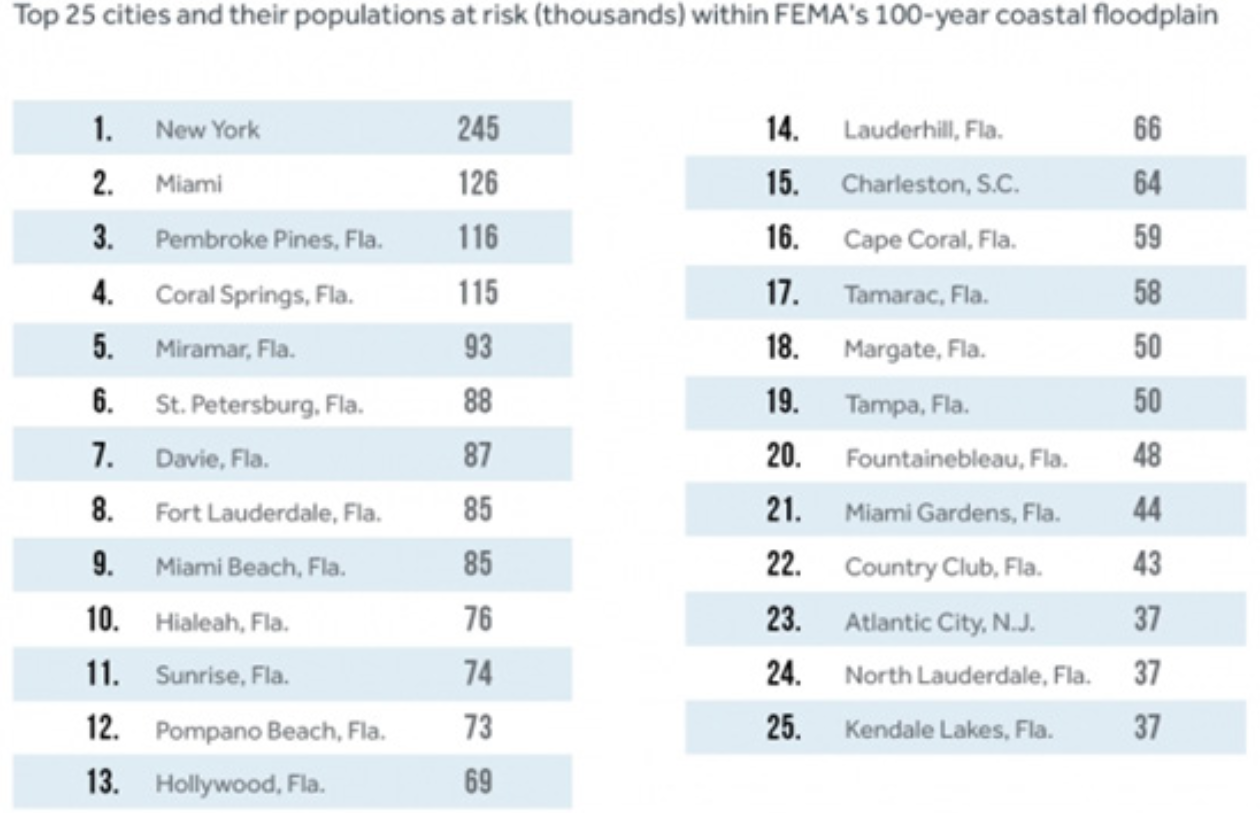

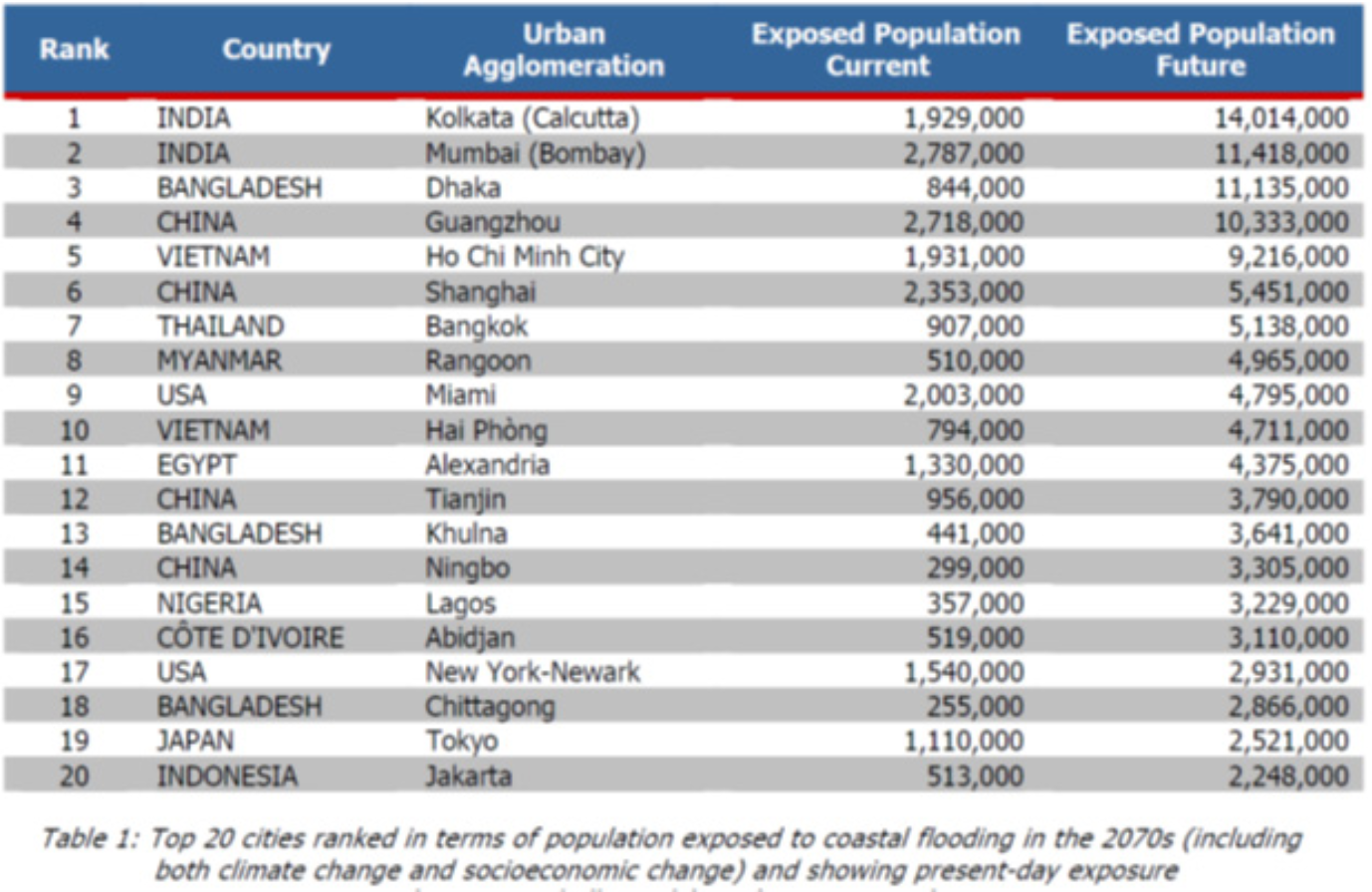

Managers must also assess relative risks posed by overall city placement, since a large enough environmental disaster will affect overall market liquidity and perception of future risk. As such, it is common to see ranking lists such as the one below, which aggregates the total population located within 100-year coastal floodplains. Such lists may see variations in exact order of risk, but all are consistent in their general output, with New York City and much of Florida on top. This type of analysis is ideal for commercial real estate, focusing on human impact rather than just geography. Put most succinctly, it is difficult to say how a global temperature rise of two degrees Celsius might affect any given city, but it is much clearer to assess how large portions of New York City being flooded would affect New York.

Of course, the total socioeconomic significance of New York is great enough that it is hard to imagine efforts being spared on the city’s preservation. Nonetheless, it is equally hard to escape the conclusion that climate change will be yet another headwind on the city’s continued cultural and economic dominance—especially since population and capital drain were preexisting realities supercharged by the COVID-19 pandemic. Images like the flooded subway stations from August 2021 are likely to be increasingly common, as the metro’s aging infrastructure faces new threats from invasive weather patterns. Indeed, infrastructure destruction—seen in both the New York floods and the loss of power in New Orleans over the summer—can still shut down an entire city even if the storm “misses” the city in more conventional flooding or wind damage.

FIGURE 4: CITIES MOST VULNERABLE TO COASTAL FLOODING TODAY

Source: “These U.S. Cities Are Most Vulnerable to Major Coastal Flooding and Sea Level Rise,” Climate Central. Oct 2017.

Florida, too, will have to face up to accelerating coastal risk, with a few major hurricanes of varying intensity in the picture. The state has a significantly greater total population exposed to sea level rises than any other state, and the erosion of coastal land throughout the Gulf exacerbates and accelerates this trend. Within the state, interior cities like Orlando will likely benefit from coastal displacement in highly exposed metros like Miami, but the entire region will suffer from the environmental and economic damage projected.

As for other parts of the nation, the Atlantic seaboard proper is overall less concerning than the Gulf of Mexico—with a few notable risk areas like Charleston, SC. Interestingly, California poses overall lower coastal erosion risk despite its geography—although the economically vital parts of San Jose are still relatively exposed. However, Southern California is particularly exposed to both heat risk (in which the city has fewer and fewer days of “California weather” in the summer), as well as just enough coastal erosion risk to lose most of its beaches. The increased risk of wildfire and drought is also very material, since it is frequently forgotten what an agricultural powerhouse the Golden State is. In short, while Miami being underwater is obviously a more drastic challenge, it is a more subtle problem to revise estimates of the “location premium” for Los Angeles in a scenario where it has lost its prized beaches and has weather we currently associate with Phoenix.

FIGURE 5: BAY AREA RISK ZONE MAP

Source: Climate Central Risk Assessment Maps

In sum, the highly clustered nature of risk areas underscores how important the specific character of local geography and urban setting are in defining the most central dangers— to coasts and coastal infrastructure. However, the case of Los Angeles shows the need to continue with more holistic assessments of total risk, since property value erosion can still occur despites less violent or disastrous manifestations of changing climate.

Global Scale

This is also why assessments of human impact often converge on the developing world and its greater exposure to all type of climate risks, especially coastal ones. First off, developing nations are more likely to have significant population build out at coastal edges, since their overall civic water and waste infrastructure is lesser. Communities in these areas have a more direct dependence on water access for both livelihoods and everyday life. This, combined with hyper urbanization and larger populations in general, is why the at-risk populations of Asian cities dwarf the figures seen earlier for the United States. In fact, of the top ten global cities most exposed to climate change by total at-risk population, nine are in Asia–including global commerce centers like Mumbai, Kolkata, Guangzhou, and Shanghai. The global scale of the issue has historically been seen as an impediment to making gains, in a “tragedy of the commons” type incentive framework. However, this global scale also means that perception of risk (especially in individual investments) will become a more central part of assessing both fundamental risk, as well as Environmental, Social, and Governance (“ESG”) issues.

FIGURE 6: RANKING OF THE WORLD’S CITIES MOST EXPOSED TO COASTAL FLOODING TODAY AND IN THE FUTURE

Source: Ranking Of The World’s Cities Most Exposed To Coastal Flooding Today And In The Future, OECD Environment Working Paper No. 1 (ENV/WKP(2007)1)

Long Term Infrastructure

The most pressing eventual concern will be how eventual infrastructure responses to climate threats drive the future form of cities. For instance, New York may choose to expend significant efforts on seawalls or other new urban infrastructure to protect Manhattan, while expending fewer resources on other Boroughs. The likely response would be declining value in areas not protected by new infrastructure but still exposed to surging coastal storms and swells.

While the full effects of climate shifts may still be a distant prospect even compared to

the investment period of a longer hold core asset, it is likely such mass planning efforts increasingly will become part of “next buyer” analysis. As such, formal announcements of climate infrastructure plans will be extremely important documents, much like transit infrastructure announcements cause value shifts even before the actual bus lines or subways are added.

Conclusion

In sum, climate change is a paradoxical challenge in that it is both universal and extremely local, as well as both having a longer time horizon, but with impacts currently real and destructive. Thus, it is extremely difficult to assess the difference between negligence and overzealous focus—especially since one perception can shift to its opposite with a particularly destructive storm. Nonetheless, the most comprehensive view suggests that core-oriented investors chiefly active in coastal gateway markets should begin placing greater scrutiny on both the micro settings of their holdings within markets, as well as their entire portfolio’s exposure to markets expected to see greater climate impacts. Much like the general environment of “unprecedented” times, this issue will increasingly shorten the distance between an abstract threat and a very concrete impact on investment values.

Moreover, the entire commercial real estate industry is increasingly putting organization momentum behind this shift, with institutional investors leading the way via diligence requests. In addition, there is increasing collaboration between private firms and public or non-profit bodies. Firm ESG policies and documentation are an increasing reality for managers seeking capital deployment from major pensions and similar institutions. While these requirements are generally still broad and designed to show sufficient awareness, it is unlikely these requirements will grow any less stringent as this issue takes greater focus. Finally, both the SEC and other federal bodies like DHS/FEMA are currently rolling out new climate-related regulations. While the macro aspects of climate risks will likely first manifest in greater organization costs or barriers for property owners, the conversation is still leading toward existential decisions regarding the long-term form and viability of the world’s foremost economic centers. Issues of this magnitude can prompt regulatory shifts that quickly spread across entire sectors, and real estate managers of all types will inevitably respond to both the policy and real-life implications. While proactive engagement may be a competitive advantage now, it may very soon be a basic requirement for solvency.

Contributors

-

Terrell Gates

Founder & CEO

-

Zach Mallow

Director of Research